TEKA manages the contributions of its insured persons which it invests aiming to create higher capital that will lead to higher pensions and to protect savings from the impact of inflation.

The contributions accumulated in individual accounts are invested for long periods, equivalent to that of a person's work life.

To achieve the abovementioned objectives, a more complex approach than a traditional bank deposit is required. This is why TEKA contributions are invested in diversified portfolios of bonds, equities and deposit products.

Responsibilities and commitments

The responsibility for managing and investing the contributions lies solely to the new Hellenic Auxiliary Pensions Defined Contributions Fund (TEKA).

The insured person's savings are managed prudently, responsibly, transparently, professionally and with the guarantee of the State.

To achieve this, TEKA abides by best governance practices, introducing enhanced transparency, accountability, professional governance and management into the social security system.

TEKA's Board of Directors, which is ultimately responsible for investments, assisted by the Fund’s Investment Committee, designs the investment strategy, sets the acceptable risk margins, approves the Fund’s Investment Regulation and ensures that the Fund is aligned with European Guidelines and Regulations on investments, prudent management, transparency and risk spreading.

TEKA’s Investments Directorate, staffed with highly qualified professional investment managers, in collaboration with external investment managers, shall implement the defined investment strategy to the best interest of TEKA’s insured persons.

TEKA’s Risk Management Unit shall be responsible for identifying, monitoring, measuring, assessing and managing the risks associated with the investments. The person heading the Risk Management Unit shall report directly to the Board of Directors.

Development periods of the investment operations

The Fund’s investment operations will develop in three periods.

Investment portfolio options

TEKA (during the third phase) shall offer a small number of appropriately designed pension products (investment portfolios) of differentiated risk (aggressive-balanced-conservative) for persons who wish to select and determine themselves the level of risk associated with their pension savings.

Using the myTEKA platform, insured persons will have the option of choosing the product in which their contributions will be invested in. This choice can be amended every three years.

Default pension product

Choosing a pension product is optional. Insured persons are automatically assigned to the default product and can choose a different pension product via the myTEKA platform.

The default pension product, which combines appropriate levels of risk, returns and security for the duration of the work life of a typical insured person, is the main pension product available to TEKA insured persons without them having to be involved any further in the management of their contributions.

"Life cycle" structure

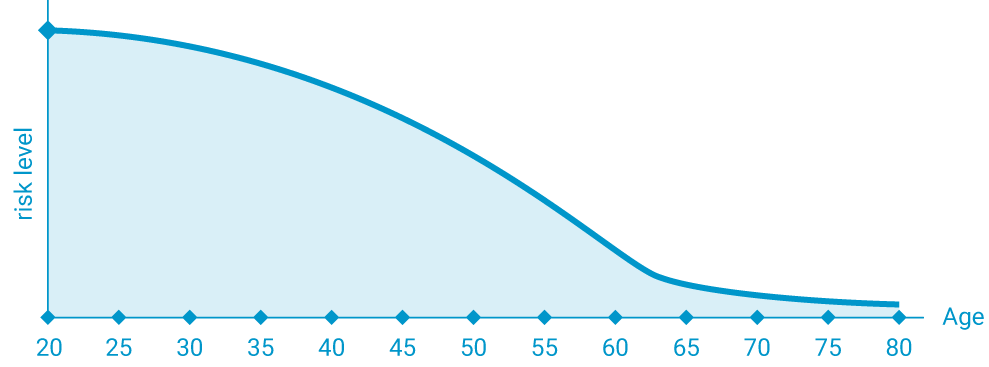

The default pension product will correspond to an investment portfolio that has a life cycle structure. This means that its composition will be personalised, diversified depending on each insured person’s age, and that it will involve higher risk for younger persons which will gradually decrease as each person nears pension age.

The life cycle structure is the most appropriate way to structure pension schemes because it incorporates the specific characteristics of each pension investment's timeframe, i.e. the fact that the savings of a person who is just starting his or her career have a long term timeframe while the savings of a person that has almost reached retirement age have a short term timeframe.